wyoming tax rate lookup

To calculate sales and use tax only. As well as to administer collect and distribute designated taxes in accordance with Wyoming Statutes and Rules for the benefit of Wyoming.

How To File Taxes For Free In 2022 Money

Fifty percent 50 of the taxes are due by November 10 in each year and the remaining fifty percent 50 of the taxes are due by May 10 of the succeeding.

. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6. Find the TCA tax code area for a specified location.

The Excise Division is comprised of two functional sections. ZIP--ZIP code is required but the 4 is optional. Click the link below to access the Tax Bill Lookup.

Property record cards are created maintained and available for. Wyoming has one of the lowest median property tax rates in the United States with only eleven states collecting a lower. 31 rows The latest sales tax rates for cities in Wyoming WY state.

Address Lookup for Jurisdictions and Sales Tax Rate. See Results in Minutes. This includes owner names mailing addresses structure photos and drawings parcel sketches lists of building permits and histories of ownership transfers.

Use this search tool to look up sales tax rates for any location in Washington. The City Assessors office maintains a database of Wyomings approximately 25000 real and personal property parcels. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

Look Up Any Address in Wyoming for a Records Report. Taxes are due and payable at the office of the County Treasurer of the county in which the taxes are levied. Exemptions to the Wyoming sales tax will vary by state.

AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. Each states tax code is a multifaceted system with many moving parts and Wyoming is no exception. Streamlined Sales Tax Project.

The Wyoming WY state sales tax rate is currently 4. The Wyoming sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the WY state sales tax. Tax Estimator Tax Rates Parks and Recreation Recreation Program Registration Adult Sports Scholarships Trick or Treat Trail.

To lookup the sales tax due on any purchase use our Wyoming sales tax calculator. Prescription drugs and groceries are exempt from sales tax. 39-15-105 a viii O which exempts sales of tangible personal property or services.

Counties in Wyoming collect an average of 058 of a propertys assesed fair market value as property tax per year. Find easy and cost-effective sales tax filing for your business. Ad Find Records For Any City In Any State By Visiting Our Official Website Today.

Wyoming Use Tax and You. Depending on local municipalities the total tax rate can be as high as 6. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property.

Tax rates are provided by Avalara and updated monthly. The state sales tax rate in Wyoming is 4. The base state sales tax rate in Wyoming is 4.

City of Wyoming Michigan 1155 28th St SW Wyoming MI 49509 616-530-7226 Fax 616-530-7200. Address Search by Address through Property Building Department Miscellaneous Receivable Tax and Utility Billing Records. Lookup other tax rates.

Performed for the repair assembly alteration or improvement of railroad rolling stock. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Wyoming and beyond. Look up 2022 sales tax rates for Cheyenne Wyoming and surrounding areas.

The use tax is the same rate as the tax rate of the county where the purchaser resides. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. Therefore effective July 1 2021 this exemption will be repealed.

Wyoming sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Assess value and allocate public utility property. If the total tax rate was 68 mills the formula would look like this.

Legislature did not move any bill forward to extend the sunset date on this exemption. 15 - Wyoming Use Tax View Main Article. ZIP--ZIP code is required but the 4 is optional.

Find your Wyoming combined state and local tax rate. To calculate sales and use tax only. Find Sales tax rates for any location within the state of Washington.

Use this search tool to look up sales tax rates for any location in Washington. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index.

Build your own location code system by downloading the self-extracting files to integrate into your own accounting system.

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Sales Tax Rates By City County 2022

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

New York Property Tax Calculator 2020 Empire Center For Public Policy

Pin On Ecology And That Sorta Stuff

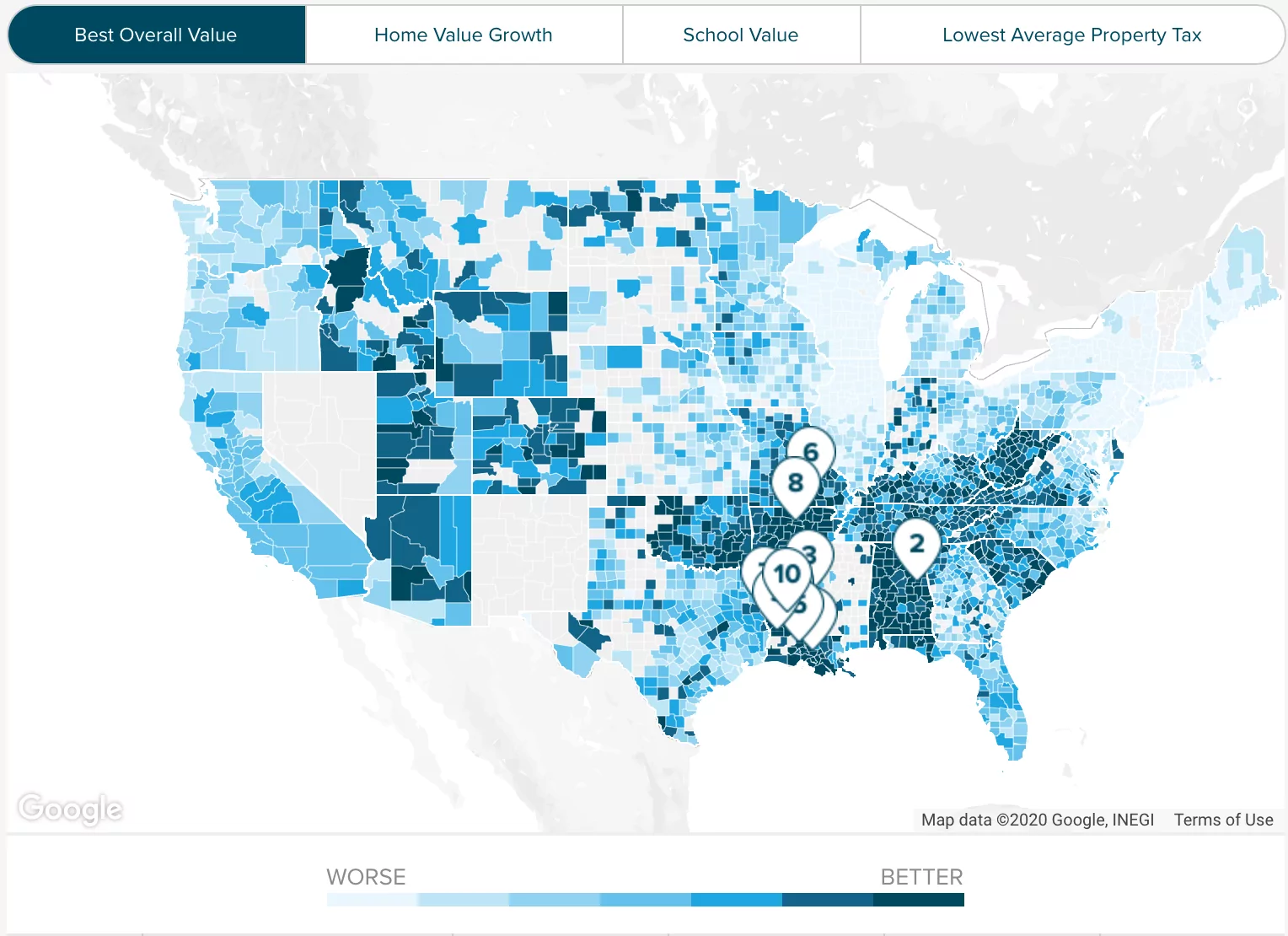

2022 Property Taxes By State Report Propertyshark

King County Wa Property Tax Calculator Smartasset

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

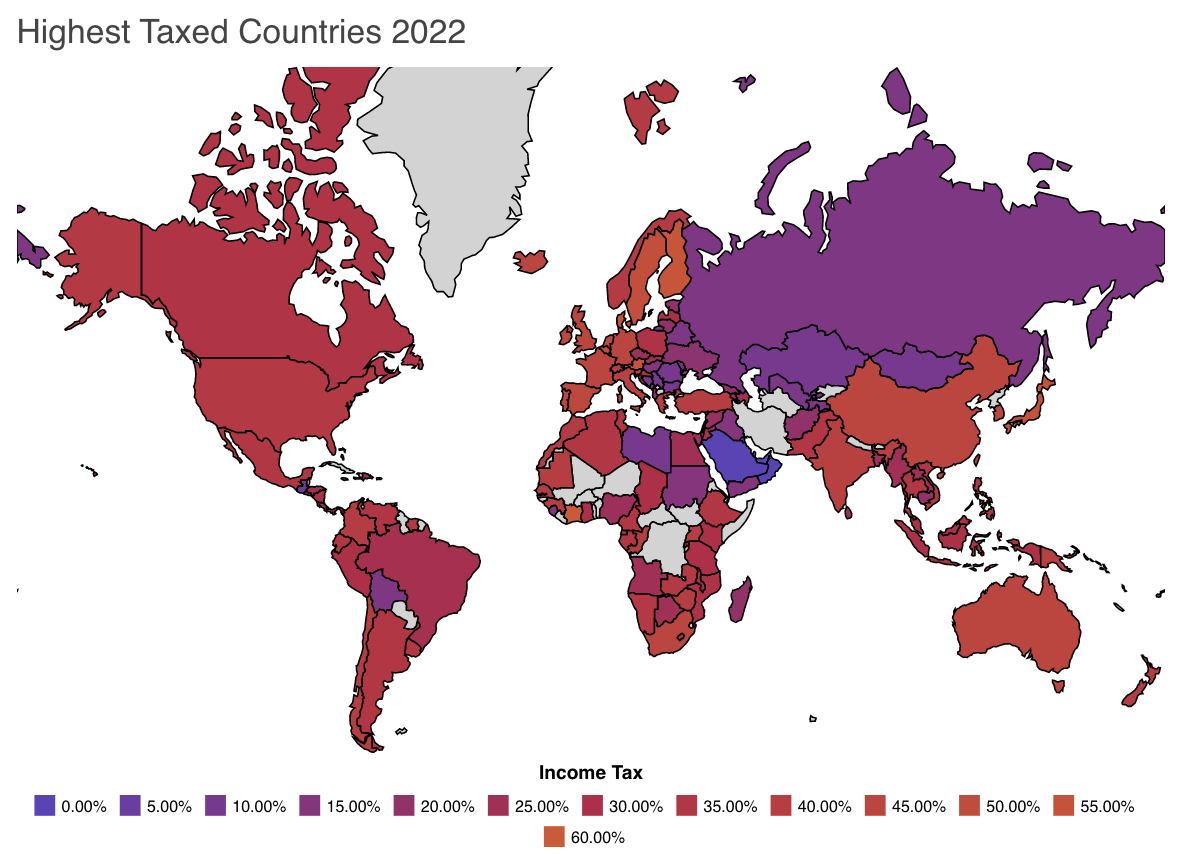

Qod Order Countries By Tax Rates United States Germany Mexico Blog

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Add Locations Sites To Your Sales Tax Account Department Of Revenue Taxation

Gross Receipts Location Code And Tax Rate Map Governments

12 Top Rated Tourist Attractions In Idaho Planetware Tourist Attraction Tourist Rafting Trips